Compliance Recap | October 2018

The Internal Revenue Service (IRS) released final forms and instructions for 2018 ACA reporting. The Department of Health and Human Services (HHS) released inflation-adjusted civil monetary penalty amounts. The Treasury, the Department of Labor (DOL), and HHS released a proposed rule on health reimbursement arrangements. The IRS released a proposed rule regarding penalties for failure to file correct information returns or furnish correct payee statements.

Congress and the President enacted a law to prohibit pharmacy gag clauses. The IRS released an information letter regarding dependent care assistance plan funds’ forfeiture. The IRS provided tax relief to victims of Hurricane Michael in Florida. The DOL released FAQs for plan participants affected by Hurricanes Florence and Michael. HHS released a proposed rule to require drug pricing transparency. The DOL and HHS released their regulatory agendas.

IRS Releases Final Forms and Instructions for 2018 ACA Reporting

The Internal Revenue Service (IRS) released instructions for both the Forms 1094-B and 1095-B and the Forms 1094-C and 1095-C and Forms 1094-B, 1095-B, 1094-C, and 1095-C. There are no substantive changes in the forms or instructions between 2017 and 2018, beyond the further removal of now-expired forms of transition relief. There is a minor formatting change to Forms 1095-B and 1095-C for 2018. There are dividers for the entry of an individual’s first name, middle name, and last name.

Reporting will be due early in 2019, based on coverage in 2018. For the calendar year 2018, Forms 1094-C, 1095-C, 1094-B, and 1095-B must be filed by February 28, 2019, or April 1, 2019, if filing electronically. Statements to employees must be furnished by January 31, 2019.

All reporting will be for the 2018 calendar year, even for non-calendar year plans.

Read more about the final forms and instructions.

HHS Releases Inflation-Adjusted Federal Civil Penalty Amounts

The Department of Health and Human Services (HHS) issued its Annual Civil Monetary Penalties Inflation Adjustment. Here are some of the adjustments:

- Medicare Secondary Payer:

- For failure to provide information identifying situations where the group health plan is primary, the maximum penalty increases from $1,157 to $1,181 per failure.

- For an employer who offers incentives to a Medicare-eligible individual to not enroll in employer-sponsored group health that would otherwise be primary, the maximum penalty increases from $9,054 to $9,239.

- For willful or repeated failure to provide requested information regarding group health plan coverage, the maximum penalty increases from $1,474 to $1,504.

- Summary of Benefits and Coverage: For failure to provide, the maximum penalty increases from $1,105 to $1,128 per failure.

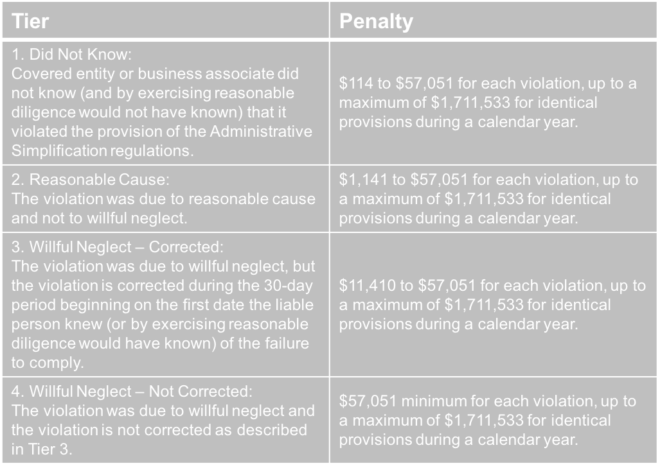

- Health Insurance Portability and Accountability Act (HIPAA):

The adjustments are effective for penalties assessed on or after October 11, 2018, for violations occurring after November 2, 2015.

Treasury, DOL, and HHS Releases Proposed Rule on Health Reimbursement Arrangements

The Department of the Treasury (Treasury), Department of Labor (DOL), and Department of Health and Human Services (HHS) (collectively, the Departments) released their proposed rule regarding health reimbursement arrangements (HRAs) and other account-based group health plans. The DOL also issued a news release and fact sheet on the proposed rule.

The proposed rule’s goal is to expand the flexibility and use of HRAs to provide individuals with additional options to obtain quality, affordable healthcare. According to the Departments, these changes will facilitate a more efficient healthcare system by increasing employees’ consumer choice and promoting healthcare market competition by adding employer options.

To do so, the proposed rules would expand the use of HRAs by:

- Removing the current prohibition against integrating an HRA with individual health insurance coverage (individual coverage)

- Expanding the definition of limited excepted benefits to recognize certain HRAs as limited excepted benefits if certain conditions are met (excepted benefits HRA)

- Providing premium tax credit (PTC) eligibility rules for people who are offered an HRA integrated with individual coverage

- Assuring HRA and Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) plan sponsors that reimbursement of individual coverage by the HRA or QSEHRA does not become part of an ERISA plan when certain conditions are met

- Changing individual market special enrollment periods for individuals who gain access to HRAs integrated with individual coverage or who are provided QSEHRAs

Public comments are due by December 28, 2018. If the proposed rule is finalized, it will be effective for plan years beginning on or after January 1, 2020.

IRS Releases Proposed Rule Regarding Penalties for Failure to File Correct Information Returns or Furnish Correct Payee Statements

The Internal Revenue Service (IRS) released its proposed rule relating to penalties for failure to file correct information returns or furnish correct payee statements. The proposed rule contains safe harbor exceptions that apply in circumstances when an information return or payee statement is otherwise correct, is timely filed or furnished and includes a de minimis dollar amount error.

A dollar amount error is a de minimis error if the difference between any single amount in error and the correct amount is not more than $100, or, if the difference relates to an amount of tax withheld, it is not more than $25.

Generally, when the safe harbor exception applies to an information return or payee statement and the return or statement is otherwise correctly and timely filed or furnished, no correction is required and, for purposes of Sections 6721 or 6722, the document is treated as having been filed or furnished with all of the correct required information.

The proposed safe harbor exception would apply to information reported on the Forms 1094/1095, Form W-2, and Form 1099-R.

Public comments are due by December 17, 2018.

Congress and the President Enact Law Prohibiting Pharmacy Gag Clauses

Congress and the President enacted the Patient Right to Know Drug Prices Act (Act) that prohibits any restriction on a pharmacy’s ability to inform customers about certain prescription drug costs.

The Act prohibits a group health plan (or a health insurance issuer offering group or individual health insurance coverage, or a pharmacy benefits management service working with a health plan or health insurance issuer) from taking the following actions against a pharmacy that dispenses a prescription drug to an enrollee in the plan or coverage:

- restricting, directly or indirectly, the pharmacy from informing an enrollee of any difference between the enrollee’s out-of-pocket prescription drug cost under the plan or coverage and the amount that the enrollee would pay for the prescription drug without using any health plan or insurance coverage, or

- penalizing the pharmacy for informing an enrollee of any difference between the enrollee’s out-of-pocket prescription drug cost under the plan or coverage and the amount that the enrollee would pay for the prescription drug without using any health plan or insurance coverage.

IRS Releases Information Letter Regarding DCAP Fund Forfeiture

The Internal Revenue Service released Information Letter 2018-0027 (Letter) to confirm that a participant’s dependent care assistance plan (DCAP) funds can be forfeited if a participant does not timely submit documentation of dependent care expenses. The Letter explains that, although the Treasury’s regulations do not specify a length of time for submitting expenses, the cafeteria plan document should specify the deadline for submitting expenses.

The Letter also explains that the plan administrator should apply the deadline to all participants on a uniform and consistent basis. A cafeteria plan must operate according to its written plan or the employees’ elections between taxable and nontaxable benefits are includible in the employees’ income.

Tax Relief for Victims of Hurricane Michael in Florida

Victims of Hurricane Michael that took place beginning on October 7, 2018, in Florida may qualify for tax relief from the Internal Revenue Service (IRS). The President declared that a major disaster exists in Florida. The Federal Emergency Management Agency’s major declaration permits the IRS to postpone deadlines for taxpayers who have a business in certain counties within the disaster area.

The IRS automatically identifies taxpayers located in the covered disaster area and applies automatic filing and payment relief. But affected taxpayers who reside or have a business located outside the covered disaster area must call the IRS disaster hotline at 866-562-5227 to request this tax relief.

Last month, the IRS extended deadlines for victims of Hurricane Florence in certain counties of North Carolina, South Carolina, and Virginia.

DOL Releases FAQs for Plan Participants Affected by Hurricanes Florence and Michael

The Department of Labor (DOL) released its FAQs for Participants and Beneficiaries Following Hurricanes Florence and Michael to answer health benefit and retirement benefit questions. The FAQs cover topics including:

- Whether an employee will still be covered by an employer-sponsored group health plan if the worksite closed

- Potential options such as special enrollment rights, COBRA continuation coverage, individual health coverage, and health coverage through a government program in the event that an employee loses health coverage

HHS Releases Proposed Rule to Require Drug Pricing Transparency

The Department of Health and Human Services (HHS) released its proposed rule that would require direct-to-consumer television advertisements of prescription drugs and biological products to include the Wholesale Acquisition Cost (WAC or list price) of that prescription drug or biological product.

The proposed rule would require the following written statement to appear at the end of an advertisement, against a contrasting background, for sufficient duration, and in front that allows the statement to be easily read:

‘‘The list price for a [30-day supply of] [typical course of treatment with] [name of the prescription drug or biological product] is [insert list price]. If you have health insurance that covers drugs, your cost may be different.’’

The advertising requirement would only apply to prescription drugs and biological products that cost $35 or more per month and for which reimbursement is available, directly or indirectly, by Medicare or Medicaid.

To enforce the advertising requirement, the proposed rule would require HHS to maintain a public list that identifies prescription drugs and biological products that are advertised in violation with the rule. HHS would post this list on the Centers for Medicare & Medicaid Services (CMS) website at least annually.

Public comments are due by December 17, 2018.

DOL and HHS Release Their Regulatory Agendas

The Department of Labor (DOL) released its regulatory agenda and the Department of Health and Human Services (HHS) released its regulatory agenda. Each agenda provides a list of regulations that the agency is currently working on, including the rulemaking stage, to help employers anticipate a potential change in certain areas of employee benefits.

The Question of the Month

- What is the status of the Form 5500 proposed rule, that if adopted as a final rule, would generally apply for plan years beginning on or after January 1, 2019?

- Although the Department of Labor (DOL), Internal Revenue Service (IRS), and Pension Benefit Guaranty Corporation (PBGC) proposed Form 5500 filing changes in 2016, the agencies have not released any final rules regarding Form 5500 filing.

At the American Bar Association’s ERISA Basics National Institute in October 2018, a DOL representative unofficially said that, due to President Trump’s Executive Order, the DOL has some other higher priority items that the DOL needs to address before it can address the Form 5500 proposed regulations. The DOL representative also unofficially said that it’s likely that new proposed Form 5500 regulations would be issued to allow for another round of public comment. However, the DOL representative didn’t have a timeline on when the additional proposed regulations might be released.