Compliance Recap | June 2018

The U.S. Department of Labor issued final regulations regarding association health plans. The U.S. Department of Justice filed a response in ongoing litigation regarding the constitutionality of the Patient Protection and Affordable Care Act. The Centers for Medicare and Medicaid Services released a form that certain plan sponsors will use for reporting limited wraparound coverage.

DOL Issues Final Regulations Regarding Association Health Plans

On June 19, 2018, the U.S. Department of Labor (DOL) published Frequently Asked Questions About Association Health Plans (AHPs) and issued a final rule that broadens the definition of “employer” and the provisions under which an employer group or association may be treated as an “employer” sponsor of a single multiple-employer employee welfare benefit plan and group health plan under Title I of the Employee Retirement Income Security Act (ERISA).

The final rule is intended to facilitate adoption and administration of AHPs and expand health coverage access to employees of small employers and certain self-employed individuals.

The final rule will be effective on August 20, 2018. The final rule will apply to fully-insured AHPs on September 1, 2018, to existing self-insured AHPs on January 1, 2019, and to new self-insured AHPs formed under this final rule on April 1, 2019.

Read more about the final rule.

Status of Court Case Challenging ACA Constitutionality

In June 2018, the U.S. Department of Justice (DOJ) filed a response in ongoing litigation regarding the individual mandate and the Patient Protection and Affordable Care Act (ACA).

As background, earlier this year, twenty states filed a lawsuit asking the U.S. District Court for the Northern District of Texas to strike down the ACA entirely. The lawsuit came after the U.S. Congress passed the Tax Cuts and Jobs Act in December 2017 that reduced the individual mandate penalty to $0, starting in 2019.

The DOJ argues that the individual mandate is unconstitutional without the penalty. The DOJ also argues that because the guaranteed issue and community rating provisions are inseverable from the individual mandate, the guaranteed issue and community rating provisions are also unconstitutional.

Further, the DOJ argues that because the individual mandate penalty of $0 starts in 2019, the district court should not immediately strike the individual mandate, guaranteed issue, and community rating portions of the ACA. Instead, the DOJ asks the district court to declare that the individual mandate, guaranteed issue, and community rating provisions will be unconstitutional as of January 1, 2019.

It’s too early to determine whether the plaintiffs, the DOJ, or the other defendants will prevail in their arguments. Even if the district court makes a decision in the next few weeks, its decision will likely be appealed.

CMS Releases Form for Reporting Wraparound Excepted Benefits

Under a 2015 final rule by the Internal Revenue Service, U.S. Department of Labor, and U.S. Department of Health and Human Services, certain employers may offer limited wraparound coverage under one of two narrow pilot programs.

These wraparound benefits are considered an excepted benefit and are generally exempt from certain requirements of federal laws, including ERISA, the Internal Revenue Code, and parts of the Patient Protection and Affordable Care Act.

Under the final rule, plan sponsors who offer limited wraparound coverage have reporting requirements. In December 2017, the Centers for Medicare and Medicaid Services (CMS) issued a notice for comments on a proposed reporting form.

On June 25, 2018, the CMS published its Reporting Form for Plan Sponsors Offering Limited Wraparound Coverage. A plan sponsor of limited wraparound coverage must file the form once, within 60 days of the form’s publication (by August 24, 2018), or 60 days after the first day of the first plan year that limited wraparound coverage is first offered.

Question of the Month

- Who must pay the Patient-Centered Outcomes Research Institute (PCORI) fee and when is the fee due?

- The fee must be determined and paid by:

- The insurer for fully insured plans (although the fee likely will be passed on to the plan)

- The plan sponsor of self-funded plans, including HRAs

- The plan’s TPA may assist with the calculation, but the plan sponsor must file IRS Form 720 and pay the applicable fee

- If multiple employers participate in the plan, each must file separately unless the plan document designates one as the plan sponsor

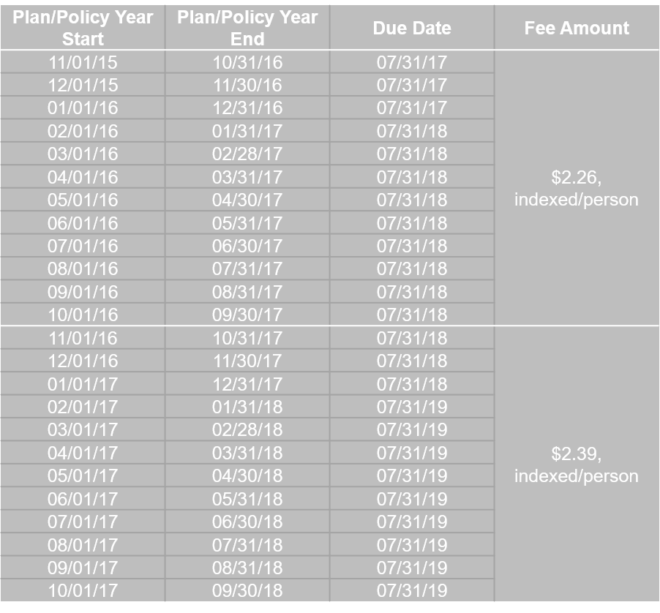

The fee is due by July 31 of the year following the calendar year in which the plan/policy year ends. For example: